SPECIALISING IN MAXIMISING CAPITAL ALLOWANCES CLAIMS.

SPECIALISING IN MAXIMISING CAPITAL ALLOWANCES CLAIMS.

ABOUT US

After heading up the South African capital allowances practice for a Big Four accountancy firm, Vas Naidoo founded Capital Allowances Specialists (Pty) Limited.

Vas is registered with The Royal Institution of Chartered Surveyors (RICS), the Association of Taxation Technicians (ATT) in the UK and with the South African Institute of Tax Professionals (SAIT). In addition, Vas is also recognised as a tax practitioner by SARS.

We are an independent company specialising in maximising capital allowances claims and advising on government manufacturing incentives.Using our unique methodology, we provide a complete range of services from claim preparation to tailored planning.It is rare to find the experience and combination of tax and quantity surveying skills that we have and which are necessary to maximise tax savings on property expenditure.

We have wide industry experience, including particular strengths in:

- Property investment (e.g. offices, industrial, shopping centres)

- Manufacturing

- Hospitals

- Infrastructure (i.e. telecoms, power, rail)

We observe and act in accordance with the regulations and ethical guidelines of the relevant professional bodies.

Our detailed conditions and terms of business are provided with our client engagement letter.

Our professional indemnity insurer is The Hollard Insurance Company Limited

WHAT ARE - CAPITAL ALLOWANCES?

Capital allowances are an important tax relief tool that can help businesses significantly reduce their tax liability. They allow businesses to claim tax relief on certain capital expenditure, such as the purchase of equipment, machinery, new/existing buildings and qualifying repairs expenditure. Claiming capital allowances enables businesses to lawfully reduce their taxable profits resulting in cash to be usefully deployed elsewhere in the business.

With capital allowances, businesses can invest in new/existing buildings and equipment while enjoying the benefits of significant tax savings. This provides a valuable incentive for businesses to invest in their growth and development, while also improving their cash flow and profitability.

By taking advantage of this invaluable tax relief, businesses can invest in their future growth and success, while also maximizing their returns and minimizing their tax liability.

Capital Allowances are available when:

- Commercial property is acquired for investment or occupation.

- Commercial new-build, extension and refurbishment works are undertaken.

- Other types of fixed assets are purchased.

- Incurring expenditure on certain commercial infrastructure projects.

SPECIALIST EXPERTISE

We only provide advice on capital allowances and government manufacturing incentives and do not audit accounts or look to provide tax compliance or general tax advice.

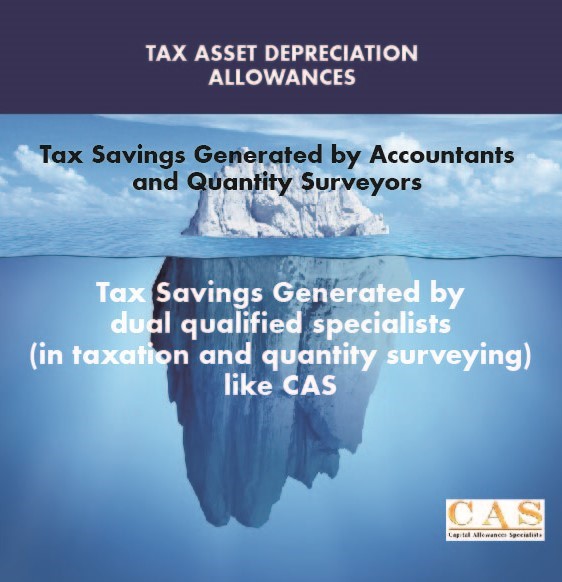

We are capital allowance specialists and have unique expertise which means that we are better positioned to understand the capital allowances tax law than most accountants and quantity surveyors.

Capital allowances tax law is particularly complicated when acquiring second-hand property and most accounting firms and quantity surveying practices do not have the combined skills-set of taxation and building cost management to unlock the invaluable tax deductions. Our dual skills-set enables us to perform the relevant apportionments and analytics to unlock the significant tax deductions on these acquisitions.

We also have working experience to provide due diligence advise when acquiring or disposing of commercial property. When acquiring commercial property – we can review sale/purchase agreements to ensure that there are no restrictions to claim the allowances you are entitled to. When disposing of commercial property – we can advise the finance and legal teams to ensure that the contract documentation contains a specific clause to ensure that there is no ‘claw back’ of allowances previously claimed.

We have also found that accountants find it difficult to maximise capital allowances for new developments, extensions, and refurbishment projects. This is because they do not have the necessary experience in navigating around construction terminology and costing of assets that qualify for tax relief. This is especially so where construction cost records are limited in scope, interpreting building drawings and for larger and more complex projects.

We can assist on any major capital project by way of our strong expertise in quantity surveying and taxation, and using our familiarity of the relevant tax cases (in South Africa and the United Kingdom) to support your tax deduction claims. The results are maximised, robust and fully substantiated claims for capital allowances.

HOW DOES CAS ADD VALUE

Capital allowances claims are ideally suited to being dealt with on a stand-alone basis separately to other tax matters. We can work alongside other advisors without any conflicts of interest or scope overlap issues occurring.

We assist taxpayers to apply the law robustly and accurately to identify the tax relief that they are legally entitled to. Correctly claiming capital allowances will not sour a taxpayers’ relationship with SARS.

Our unique combination of competencies (quantity surveying and taxation) allows us to provide our clients with an integrated solution for their capital allowances needs. We don’t only use tax authorities’ populated lists of the few qualifying assets to identify tax allowances. We are qualified tax specialists and have extensive experience of tax case law dealing with capital allowances and this together with our quantity surveying expertise enables us to drill deeply into procurement information (drawings, bills of quantities etc.) to maximise tax deductions and ensure they can robustly withstand tax authority scrutiny.

OUR DIRECTOR

Vas obtained his degree (cum laude) in quantity surveying in 2000. He worked for a large international construction firm and gained experience on a wide range of construction projects including regional malls, high-rise offices, airports, hospitals and theme parks.

He was head-hunted by a UK based project services firm specialising in Private Finance Initiative projects, and immigrated to the UK in 2002. Vas obtained an additional quantity surveying qualification with the Royal Institution of Quantity Surveyors shortly thereafter.

Vas joined a large professional quantity surveying firm in 2004 and worked on various large water infrastructure and telecommunications projects. Vas played a pivotal role in developing strategies to close out commercial contracts with stakeholders for large infrastructure projects.

He then pursued a career in capital allowances in 2006 and joined the London based capital allowances team of Ernst and Young.

Vas gained experience and developed his specialist competency in capital allowances by working on a range of diverse projects like the BBC’s new studious and offices in London, project managing the capital allowances claims for a number of prominent London based property investment companies, and rail and telecommunications projects. He furthered his studies in taxation and obtained his UK tax qualifications through the accredited Association of Tax Technicians.

He was transferred to Ernst and Young’s Johannesburg office in 2010 to build the first team in South Africa to provide specialist capital allowances offerings. After parting ways in 2012, he founded Capital Allowances Specialists. Vas is a member of the South African Institute of Tax Practitioners and is also a registered tax practitioner with SARS.

Vas is one of only a very few capital allowances professionals internationally which is qualified both as a chartered quantity surveyor and in taxation.

He is responsible for the delivery and quality of our capital allowances service. He has also provided guest capital allowances lectures to the University of Cape Town’s Postgraduate Programme in Property Studies.

Tax Asset Depreciation Allowance

TESTIMONIALS

Vas performs his work in a professional manner, delivers on time, and did not mind sharing his knowledge with us.

High level of technical knowledge and work quality – quick response and always helpful!

I was consistently impressed with quick turn around times from Vas. He was committed to getting the project done in a short space of time. He is truly an expert in his field.

My experience of Vas is that he is a people-person who delivers a timeous, professional and excellent service. I would have no hesitation in recommending Vas’ capital allowances skills to other property owners!

Always walking that extra mile in delivering the end product and always providing feedback on the progress. Excellent technical skills and ability.

Vas is professional in the way he approaches his work, good at communicating the progress of a specific task, and presents the final product in a detailed and understandable manner. It was a pleasure working with him.

Fantastic working relationship – I know that I can always rely on Vas to get us the results we are after in often very tight timelines!

THOUGHT LEADERSHIP

Open PDF file: Business Day article 25 Sep 2013

Open PDF file: Business Day article 27 June 2012

Open PDF file: Business Day article 28 Nov 2012